题库 / GMATLA-TA-16

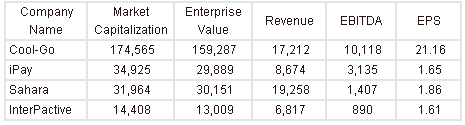

All figures are in millions (M) except for EPS which is in $/share. EPS stands for Earnings Per Share. Market Capitalization is defined as stock price (measured in $/share) multiplied by shares outstanding.

"Earnings" when used in the expression EPS (earnings per share) and P/E (price-to-earnings ratio) refer to the metric net income (not shown).

Capitalization metrics such as market capitalization value and enterprise value are as of January 30, 2008. Other metrics are as of December 2007.

EBITDA is a financial metric for profitability and is defined as earnings before interest, taxes, depreciation, and amortization.

For each of the following, select Yes if the statement is true based on the information provided; otherwise select No.

| Yes | No | |

|---|---|---|

|

|

|

If the EV/Revenue multiple is expressed as a ratio of Enterprise Value to Revenue, the median EV/Revenue multiple for this set of 4 companies is between 2.0x and 3.0x.

|

|

|

|

If Cool-Go's P/E (price-to-earnings or market capitalization-to-earnings) ratio is 25.9, the number of Cool-Go shares outstanding is greater than 350M.

|

|

|

|

The range for Enterprise Value is greater than the range for Market Capitalization.

|

还没有题目讲解(毕出老师会陆续发布对官方考题的解读,请保持关注)。