题库 / GMATLA-MSR-46

Investigations

The Securities Trading Commission (STC) recently examined the acquisitions of several firms listed in the public stock market in 2000. The investigators wanted to examine the extent to which four different variables -- market capitalization, management's growth expectations (as measured by earnings growth), firm size, and investor sentiment -- affected suspicious insider trading activity. They hypothesized that all four variables would show a strong positive correlation to suspicious insider trading activity. However, after examining the acquisitions listed, they were surprised to find that none of the variables showed a strong positive correlation with suspicious insider trading activity, and in fact market capitalization and investor sentiment both showed a strong negative correlation.

The investigators also discovered that nearly all of these acquisitions seemed to have a slight jump in stock price in the days prior to acquisition, suggesting suspicious insider trading activity was prevalent. Such insider trading activity, if true, constitutes unfairness because it allows insiders to make a quick guaranteed profit that public investors have no access to. Investigators noted that new enforcement will be needed to assure a more fair and honest stock market.

Acquisitions

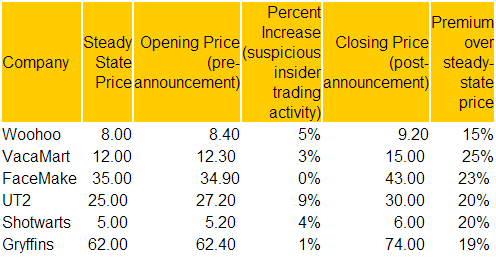

The table lists companies that were acquired in year 2000 together with the average share price in the last 30 days excluding the last 3 days before acquisition announcement ("Steady State" price), the pre-announcement opening share price, the post-announcement closing share price, and premium paid for the acquisition relative to the steady state price. Prices are in US dollars.

For each of the following statements, select Supported if the statement is supported by the information provided about acquisitions. Otherwise select Not Supported.

| Yes | No | |

|---|---|---|

|

|

|

The market capitalization of UT2 was likely lower than that of FaceMake at the time of their acquisitions.

|

|

|

|

UT2 and Shotwarts were approximately the same size at the time of their acquisitions.

|

|

|

|

When their acquisitions were announced, investor sentiment toward UT2 was likely higher than it was toward FaceMake or Gryffins.

|